The smart Trick of Home Improvement News That Nobody is Talking About

Wiki Article

Excitement About Home Improvement News

Table of Contents6 Easy Facts About Home Improvement News ShownThe smart Trick of Home Improvement News That Nobody is Talking AboutSome Known Factual Statements About Home Improvement News The 7-Minute Rule for Home Improvement News

So, by making your residence more secure, you can actually earn a profit. The inside of your home can obtain outdated if you do not make modifications as well as upgrade it every as soon as in a while. Interior design styles are constantly altering and what was fashionable 5 years back may look ludicrous today.You might also really feel tired after checking out the very same setup for several years, so some low-budget adjustments are constantly welcome to provide you a little change. You select to incorporate some traditional elements that will remain to seem present as well as elegant throughout time. Don't stress that these improvements will certainly be expensive.

Pro, Pointer Takeaway: If you really feel that your residence is also small, you can redesign your basement to enhance the quantity of room. You can use this as an extra room for your household or you can lease it bent on produce extra income. You can take advantage of it by employing specialists that supply redesigning services.

Getting The Home Improvement News To Work

House improvements can boost the means your home looks, however the advantages are extra than that. When you deal with a trusted improvement company, they can help you improve efficiency, function, way of living, and worth. https://www.ted.com/profiles/44656877/about. Hilma Construction in Edmonton deals total remodelling services. Review on to find out the benefits of residence improvements.

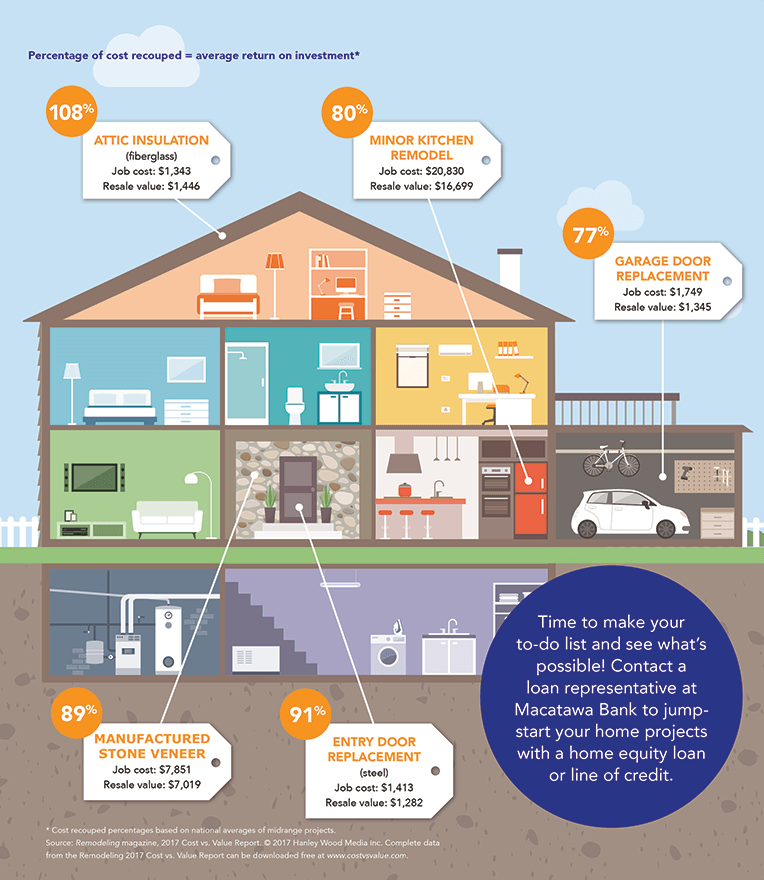

Not only will it look obsolete, but locations of your house as well as important systems can start to reveal wear. Routine residence upkeep and repairs are needed to preserve your residential or commercial property value. A home improvement can assist you keep and enhance that value. Jobs like outside remodellings, cooking area remodellings, as well as bathroom remodels all have superb returns on investment.

Residence equity financings are preferred amongst homeowners wanting to fund restorations at a reduced rates of interest than various other funding choices. One of the most usual uses for residence equity. https://www.blogtalkradio.com/hom3imprvmnt funding are residence improvement projects and financial debt consolidation. Making use of a house equity funding to make residence renovations includes a couple of benefits that other uses don't.

Top Guidelines Of Home Improvement News

That set rate of interest suggests your regular monthly settlement will be regular over the regard to your funding. In an increasing interest rate environment, it may be easier to factor a fixed repayment right into your budget. The various other choice when it comes to tapping your home's equity is a home equity line of credit score, or HELOC.Both home equity fundings and also HELOCs utilize your house as security to safeguard the financing. If you can not afford your monthly repayments, you could shed your residence-- this is the biggest risk when obtaining with either kind of loan.

Think about not simply what you want today, but what will interest future purchasers since the jobs you select will certainly influence the resale worth of your home. Deal with an accountant to make certain your interest is effectively subtracted from your tax obligations, as it can save you tens of thousands of bucks over the life of the finance (deck sealing).

The smart Trick of Home Improvement News That Nobody is Discussing

Home equity loans have reduced passion rates compared to other types of lendings such as individual loans and charge card. Existing home equity rates are as high as 8. 00%, however individual financings go to 10. 81%, according to CNET's sibling website Bankrate. With a home equity loan, your interest price will be dealt with, so you don't have to stress over it increasing in a rising rates of interest environment, such as the one we remain in today.As stated above, it matters what type of restoration tasks you carry out, as particular house enhancements supply a higher return on financial investment than others. As an example, a small cooking area remodel will recoup 86% of its worth when you offer a house contrasted with 52% for a timber deck enhancement, according to 2023 information from Renovating publication that assesses the cost of redesigning projects.

While residential property worths have skyrocketed over the last 2 years, if home rates go down for any kind of reason in your location, your investment in improvements will not have in fact try this out enhanced your home's value. When you finish up owing more on your home mortgage than what your home is in fact worth, it's called unfavorable equity or being "undersea" on your home loan.

With a fixed-interest price you don't require to stress concerning your settlements going up or paying extra in interest over time. All of the cash from the financing is distributed to you upfront in one repayment, so you have accessibility to all of your funds right away.

Report this wiki page